2025: The birth year of Generation Beta, the first AI-native investors

Photo by Gantas Vaičiulėnas

April holds a special place in the financial education landscape. It is officially recognized as Financial Literacy Month in the United States. The designation reflects America's national commitment to raising awareness and supporting individuals in developing the financial skills necessary for daily life and lifelong well-being. However, while awareness is increasing, measured financial literacy levels remain stagnant. More than a decade of data shows that half of U.S. adults struggle to grasp core financial concepts.

The critical need for financial literacy

Financial literacy is the knowledge and ability to apply financial skills, including budgeting, saving, borrowing, investing and decision-making, to achieve financial well-being. Yet, national studies dating back to 2018 indicate a persistent gap in knowledge and skills. More than a decade of surveys conducted by FINRA and GFLEC show no significant improvement in financial literacy levels across the U.S. Since 2009, the average number of correctly answered financial literacy questions has declined, highlighting persistent financial knowledge and skills gaps.

A key initiative tracking financial literacy trends is the TIAA Institute-GFLEC Personal Finance Index (P-Fin Index), a joint effort by the TIAA Institute and GFLEC. The 2024 report highlights that financial literacy remains low, with only 48% of personal finance questions answered correctly by U.S. adults. The study also underscores significant disparities across demographics, with lower financial literacy among younger adults, women, and those with lower incomes. The report further reveals that lower financial literacy correlates with higher financial distress, poor retirement planning, and greater reliance on high-cost borrowing. These findings reinforce the urgency of strengthening financial education efforts at all levels.

Beyond the fundamentals

Financial literacy goes beyond the cores of budgeting, saving, borrowing and investing. It also includes:

Earning & Income Management – Understanding income sources, taxes, and maximizing earnings potential

Spending & Smart Consumerism – Making informed purchasing decisions and distinguishing between wants and needs

Credit & Debt Management – Managing credit scores, understanding interest rates, and avoiding predatory lending

Risk Management & Insurance – Recognizing the importance of insurance to mitigate financial risk

Retirement & Long-Term Planning – Preparing for financial security in later years through pensions and investment strategies

Tax Literacy – Understanding tax obligations, deductions, and optimizing financial strategies

Financial Decision-Making & Behavioral Finance – Recognizing biases and emotional influences on financial choices

Digital & Banking Literacy – Navigating modern financial tools and ensuring online financial security

Are efforts to improve financial literacy working?

Governments and private organizations have launched numerous initiatives to address the issues. For example, schools across the U.S. and Canada are integrating financial literacy into curricula. However, implementation remains inconsistent and often lacks depth. Private sector efforts make some impact, but programs typically operate at a micro or regional level. While national organizations have a broader scope, their impact is often limited in reach and effectiveness.

Our solution

In 2014, we saw the need to elevate financial literacy for kids and young adults, while they're in school, placing financial literacy alongside math, science and other core curricula in importance.

We identified credit unions as the ideal national partner in U.S. and Canada. Unlike banks, credit unions have maintained a strong local presence, resisting the shift to online-only operations while staying committed to service, co-operation and community engagement.

A well-designed educational program would also allow credit unions to engage with young people in ways few other methods could. Vital for a financial system looking to recruit younger members.

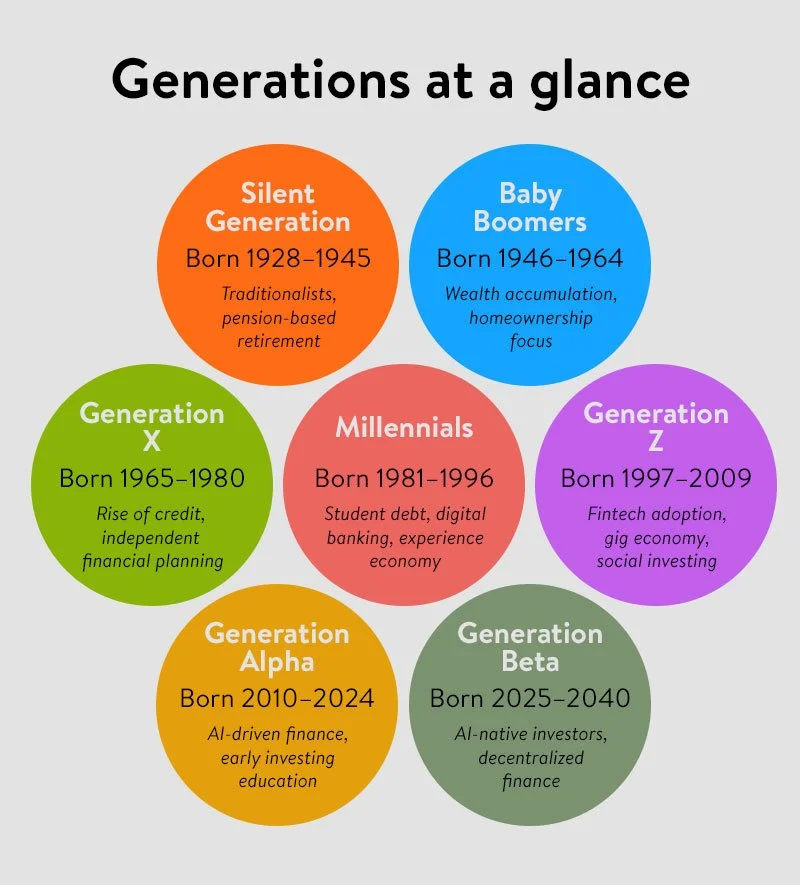

While Gen Alpha is on track to be one of the most financially savvy generations, Generation Beta will take financial evolution to the next level.

Generation Beta: The first AI-native investors (2025–2040)

With 2025 marking the birth year of Generation Beta, this cohort will be the first to live entirely in a world powered by AI, automation and digital finance. What does this mean for their financial future?

Predicted financial landscape for Gen Beta

The AI-first money experience: Gen Beta will never know a world without AI financial advisors, fully automated investing and blockchain-based transactions. Personal finance apps will function as real-time AI consultants, offering personalized financial coaching from childhood.

Financial independence at an earlier age: Digital education and micro-investing platforms will allow Gen Beta to begin investing even before they reach adolescence. Virtual economies (metaverse businesses, digital real estate and tokenized assets) will be a core part of their wealth-building strategies.

Alternative currencies and payment methods: Traditional banking may become obsolete as Gen Beta grows up in a cashless world, transacting in cryptocurrencies, central bank digital currencies (CBDCs) and AI-managed accounts. Peer-to-peer payments via blockchain will replace standard banking methods.

Sustainability-first investing: Climate change and environmental concerns will heavily influence how Gen Beta invests. Their financial choices will prioritize renewable energy, circular economies, and ethical corporations.

Longevity and work evolution: Advances in health tech may result in longer lifespans, shifting financial planning toward sustainable wealth accumulation over a much longer life. AI-powered productivity and remote work models could redefine traditional career paths, making wealth generation more decentralized.

The critical role of financial education

For both Gen Alpha and Gen Beta, financial education will be crucial in ensuring they are equipped to manage wealth effectively in an increasingly complex world. Leading researchers have emphasized that financial education must be professional, comprehensive and engaging to have a lasting impact.

Bridging the financial education gap

Despite the growing need for financial literacy, there are still gaps in financial education across North America, particularly in early education settings. Schools and colleges must prioritize structured financial education programs to ensure that both Gen Alpha and Gen Beta gain the necessary skills to navigate AI-driven financial landscapes.

Community partners can play a vital role in advancing financial literacy efforts, helping to fill gaps left by traditional education systems. Notably, North America’s credit unions have long supported financial education initiatives.

By integrating interactive, real-world financial learning experiences into educational institutions and community programs, we can help ensure that Gen Alpha and Gen Beta grow up with a strong understanding of financial principles, empowering them to make informed financial decisions.

The evolution of financial independence

Gen Alpha and Gen Beta are set to experience automated financial landscapes, AI-driven decisions and sustainability. While Gen Alpha has pioneered digital finance adaptation, Gen Beta will be the first generation born into this reality.

As 2025 welcomes the first members of Gen Beta, we enter an era where money, investing and wealth-building will be more data-driven, automated and globally interconnected than ever before. Their success will depend on access to financial tools and how well they navigate ethical AI, economic shifts and digital disruption.

The future of finance belongs to these two generations—but for Gen Beta, the journey starts now.

Let’s talk about the future of financial literacy

If you are interested in bringing a financial literacy program to your credit union, I invite you to explore It’s a Money Thing. This comprehensive library of effective and affordable financial education content is designed to engage and teach youth and young adults in an impactful way.

To see a demo and learn how you can implement financial literacy initiatives in your organization, please book a Zoom meeting with me.