Why financial literacy should start with your staff

Photo by Pavel Danilyuk

Credit unions in the U.S. and Canada already invest in financial education for members. Many run workshops, share branded content across digital and traditional channels, or use platforms like It’s a Money Thing to help members manage money more effectively. In a market where misinformation is widespread, financial stress is growing and many for-profit players offer advice that serves their interests first, the credit union’s focus on financial education is not just helpful, it is essential.

But one area remains under explored: the financial literacy of credit union staff. Most programs focus outward on youth, students or community groups while the staff handling these questions often face similar gaps. Strengthening staff financial knowledge is not only the right thing for their well‑being, but also a strategic opportunity.

Staff knowledge shapes member experience

When front‑line staff understand financial concepts, they shift from transaction to guidance. They can explain products in relatable terms. They can answer member questions with confidence and empathy. And they make financial education feel personal, not rehearsed.

Staff with working knowledge of budgeting, credit scores, saving and borrowing help foster deeper conversations. Those conversations can lead to stronger member trust, better product alignment and improved satisfaction. Not because of sales pressure but because the interaction feels helpful.

This matters more today, as younger adults enter adulthood with financial uncertainty. Research shows that globally and in North America financial literacy levels are low. Among Canadian respondents, only about 44 percent correctly answered three basic questions about interest, inflation and risk diversification. That pattern holds across U.S. data too, where fewer than one‑third can answer all three correctly. In both countries, most people struggle with these concepts, and those gaps cost them real money. Staff who can speak clearly about basic financial concepts are well placed to support members overwhelmed or misled by online misinformation.

Source: Annamaria Lusardi, GFLEC

Branches remain relevant and under utilized

Despite the rise of digital banking, credit union branches continue to draw members as trusted destinations. Research shows branch usage is declining faster among banks than credit unions. According to TimeTrade data, nearly 46 percent of credit union members visit a branch monthly or more. Other studies show that while users visit branches less frequently overall, credit union branches remain stable or even growing in some regions unlike banks, which continue branch closures.

One consumer survey found that 44 percent of banking customers still visited a branch once or twice monthly, and 69 percent said proximity to a branch was important to them. That makes branches a real strategic asset and not a liability.

But those interactions remain transactional unless staff are prepared to engage. When staff have confidence in their knowledge, each visit becomes a chance to offer guidance, build trust and reinforce financial learning.

Financial literacy supports engagement and retention

Training staff internally can boost morale, reduce stress and support retention. People who feel they are learning and growing are more likely to remain at their workplace. Gallup research confirms that workplace learning is a key predictor of retention, especially in roles exposed to high turnover.

When staff gain skills, such as through workshops or internal education sessions, they can participate in community engagement, run branch workshops or help create member‑facing content. This brings variety to routine work and strengthens connections to purpose.

Misinformation is increasing the need for credible voices

Young adults increasingly turn to social media for financial advice. Research from FINRA shows over 40 percent of Gen Z get financial information primarily from TikTok, YouTube or Instagram. Many of those sources lack oversight and reliability.

In this context, credible community‑based voices become essential. Staff equipped with basic financial literacy and communication skills can fill that gap either in person or through moderated, approved content. This positioning reinforces the credit union as a trusted local institution.

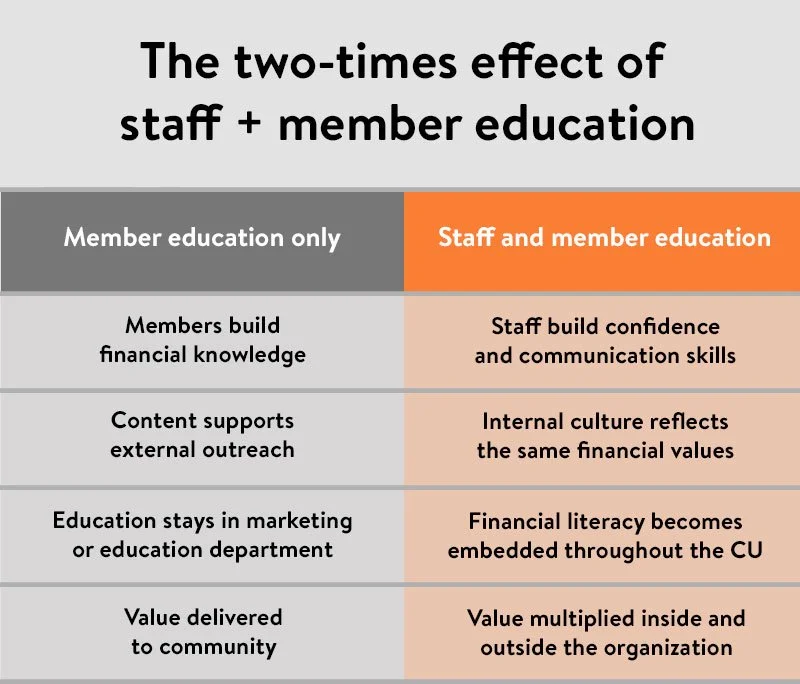

Generating two‑times value from education

Many credit unions already invest in member education programs, including It’s a Money Thing. That same material can be adapted for internal use with little effort. When staff engage with the same videos and content members receive through workshops, learning sessions or self-directed access, they build confidence and deepen their understanding.

This creates a “two times effect”: member education continues to deliver value externally, while also strengthening internal knowledge and communication. Staff become more capable of explaining, supporting and reinforcing those messages, resulting in greater overall return on the original investment.

What next steps might look like

The case for internal staff financial literacy is clear. Staff who are financially literate serve members more effectively, represent the credit union with greater confidence and stay more engaged in their roles. Progress often begins with small steps, such as inviting staff to participate in existing education programs and creating space for informal discussion.

Here are a few ways to get started:

Include staff in upcoming financial education sessions

Share content through internal channels like email or your intranet

Host short workshops, team huddles or lunch-and-learn events

Encourage staff to reflect on what they learned or found personally useful

Over time, confident and informed staff help turn routine member interactions into meaningful conversations. That strengthens both member relationships and credit union culture.