The TikTok phenomenon

How credit unions can take advantage of short-form video to connect with Gen Z

Source: Popbuz

The impacts

Financial stress in the workplace manifests into issues of mental and physical health, lower engagement and lower productivity. Per employee, it’s estimated that as much as 11.4 hours of productivity is lost per week. Over the course of a year, a full-time employee may spend more than 590 hours (74 days) thinking about personal financial issues.

Source: Popbuz

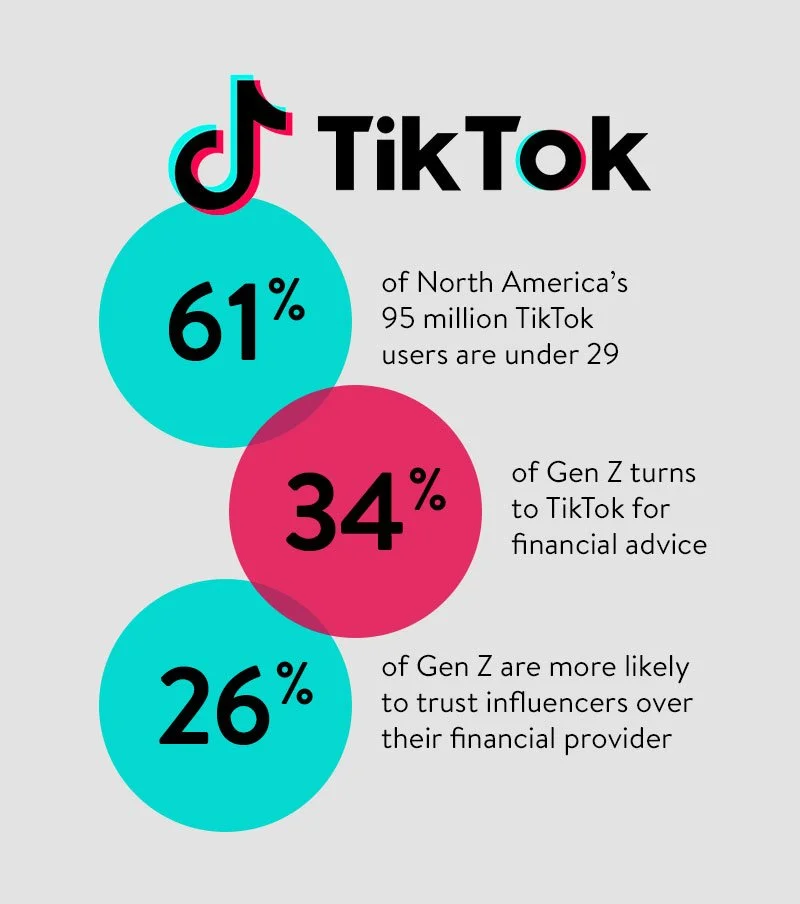

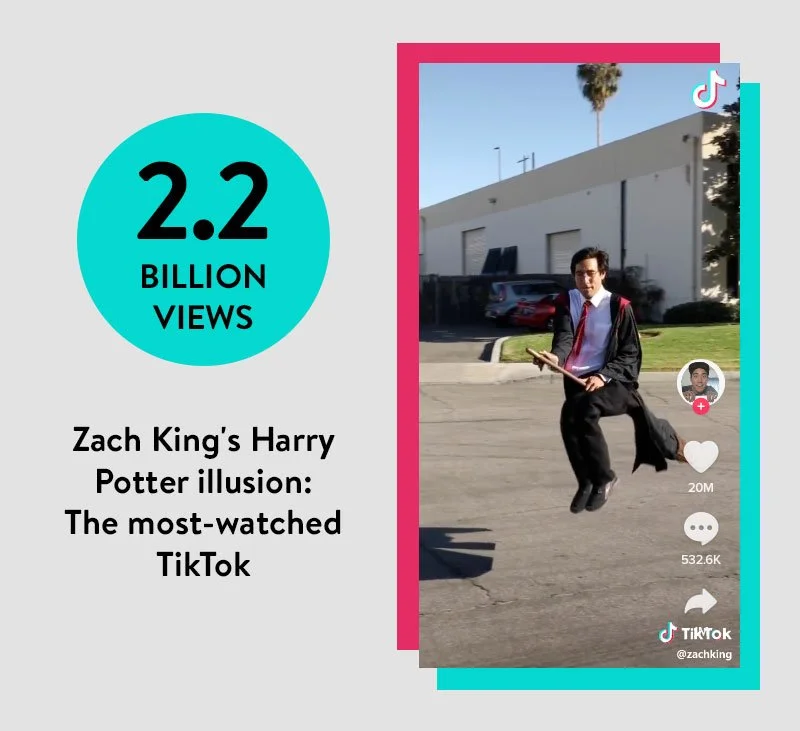

To effectively use TikTok, it's important to understand the TikTok statistics that tell you what types of users are on the platform and how they interact with the app. Worldwide, TikTok has over 1 billion monthly active users. Though it does not have as many users as Facebook, Instagram or YouTube, TikTok's recent 45% growth has garnered attention, plus it is extremely popular with kids.

Source: Qustodio

Some quick TikTok stats to ponder:

43% of Canadian and 47% of American TikTok users are between the ages of 10 and 29.

TikTok users watch around 24 hours of content per month.

TikTok is watched by children aged 4 to 15 for 87 minutes per day.

37% of TikTok users have a household income of over $100,000.

Contrastingly, 9.6% of users have an income of less than $25,000.

34% of Gen Z turn to TikTok for financial advice.

Just 24% of Gen Z seek advice from a financial advisor.

And finally, a short sales pitch...

If you are wondering where you’re going to find more time in your day to source and produce short-form video content, you’re not alone. According to Wyzowl:

23% of non-video marketers say they don’t have the time to make videos.

16% of non-video marketers say they don’t know where to start with creating videos.

At Currency Marketing, our very existence is built on helping credit unions connect with their members and communities in ways that add value and meaning. Our new Shorts Bundle of 18 fast-paced short videos that are perfect for Facebook, Twitter, Instagram and TikTok is a great example.

We created 18 short, financially informative and entertaining videos in horizontal and square formats with suggested social media post copy. It’s an exciting bundle that can be licensed on its own or added to any of our It’s a Money Thing membership plans.