Trust is the new currency: why online child safety must start with our values

How data-driven platforms are reshaping childhood and why credit unions must lead the way.

Coca-Cola, 1971 'Hilltop' Ad – "I'd like to buy the world a Coke"

In 1971, Coca-Cola launched a feel-good campaign with a jingle that promised to “buy the world a Coke.” It was innocent, optimistic and even utopian. A hillside full of smiling young people from around the world, singing in harmony. It marked the beginning of a new era: global marketing powered by emotion, identity and aspiration.

That same year, if kids wanted to see a grown-up movie, they had to sneak into the theatre. TV went static after midnight. And data privacy wasn’t even a concept, because no one was collecting any.

Today, the campaigns are still singing, but the harmony is algorithmic. The audience is younger. And the message isn’t about sharing a soda. It’s about capturing attention, behavior and data.

It’s easy to blame screens or the internet, but the deeper issue is trust, and its rapid erosion.

The illusion of online safety

For years, online safety efforts have focused more on appearances than effectiveness. Age gates are easily bypassed. Device restrictions can be disabled in minutes. And many apps designed for kids quietly trade access for data.

Worse still, these apps aren’t just collecting location data or screen time. They’re profiling behavior, feeding third-party algorithms and training AI models. The very tools positioned as educational often serve other priorities first.

Common Sense Media offers privacy evaluations to help parents and educators assess the safety of educational apps. Among the financial literacy tools they’ve reviewed, a notable percentage raise concerns, often around data sharing, behavioral tracking or unclear privacy protections. Many others have yet to be evaluated, but the early indicators point to a need for closer scrutiny in this space.

But this issue goes far beyond app stores and ratings.

Where the gatekeepers went

There was a time when content ratings carried real weight. In the U.S. and Canada, if a movie was rated 18A or R, you couldn’t just walk in. You had to get past the grouchy guy in the red blazer with the flashlight. He may have looked half-asleep, but he still tore your stub, raised an eyebrow at your age and sometimes sent you packing.

It wasn’t a flawless system. But it was a system.

Today, those gatekeepers are gone. Streaming platforms, video apps and social media are largely self-regulated. Age verification is usually just a checkbox. The systems that once filtered content by age and maturity have been replaced by algorithms that reward engagement, not appropriateness.

And kids are navigating that system alone.

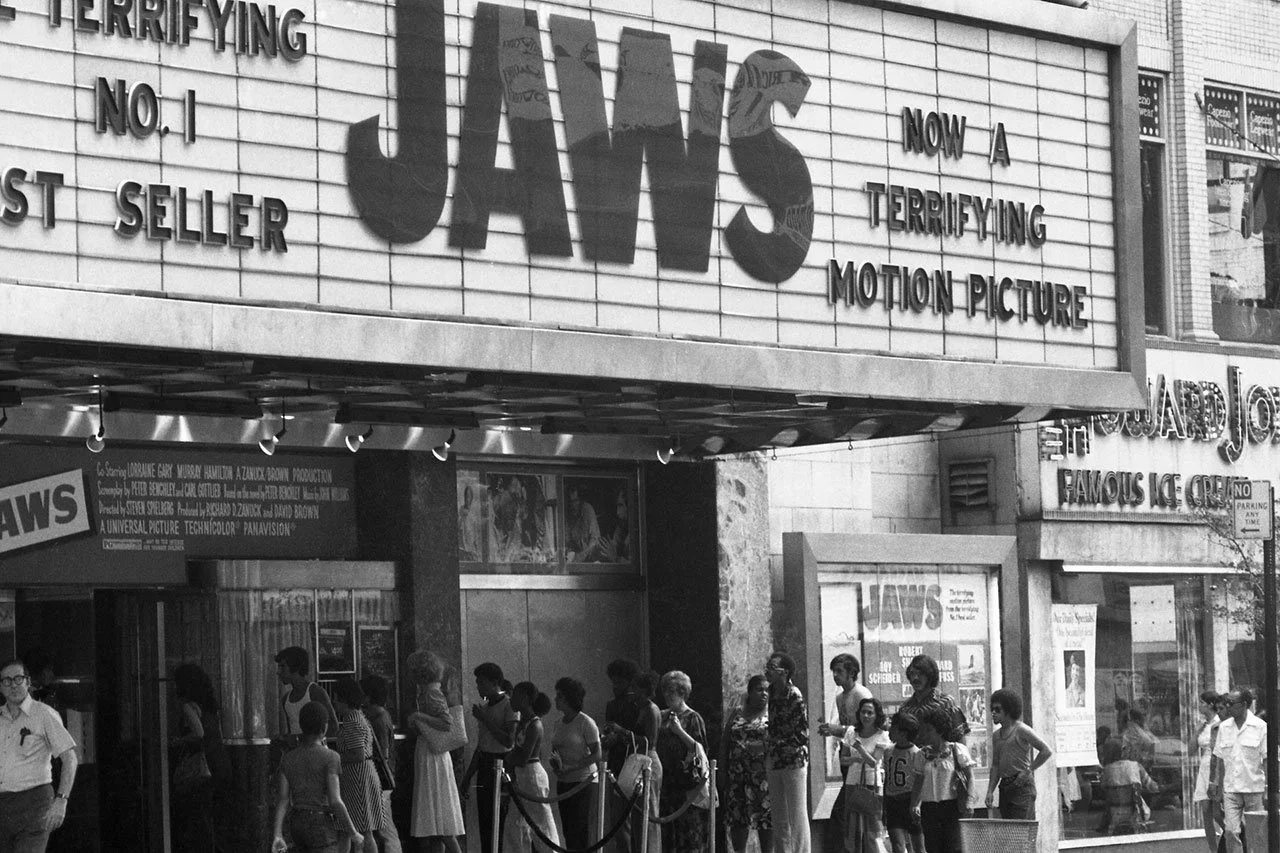

Jaws movie line up, 1975 (vintageshowbiz.com)

Jaws, then and now

When Jaws hit theaters in 1975, it was deemed too intense for younger audiences and carried an R rating in the U.S. and Canada. Still, plenty of teens snuck in anyway. Today, the same film is often classified as PG or PG-13, depending on where it's shown.

The content didn’t change. The standards did.

Data collection is the new danger zone

It’s tempting to assume that a cheerful interface or classroom-friendly design signals safety. But many educational apps, including those used in financial literacy programs are built on models that rely on data collection rather than education outcomes.

Investigations by Human Rights Watch and NPR have shown that even apps recommended for school use routinely collect device IDs, behavioral data and location. These are often gathered through embedded third-party trackers.

Legal experts have warned about the illusion of parental control. Meanwhile, Thomson Reuters estimates that hundreds of platforms used by children operate in legal gray zones when it comes to surveillance, consent and cross-border data transfers.

In the U.S., the Department of Justice has sued TikTok over COPPA violations, showing that even global platforms are not immune from scrutiny.

This is no longer a theoretical risk. It is structural, persistent and legally volatile.

Fraud at scale: a new era of manipulation

Online safety isn’t just about protecting kids from what they see. It’s about who or what might be trying to reach them.

We’ve entered an age where impersonation is easy. AI can generate realistic avatars, clone voices and simulate human conversation. These tools are already being used to scam adults through phishing and synthetic identity fraud. It's only a matter of time before children become the next target for influence, manipulation or worse.

In the past, trust kept society functioning. It allowed for the safe exchange of goods, services and relationships. In the future, trust that is verifiable, rooted in values and genuinely earned will be society’s most valuable currency.

The coming trust economy

As headlines emerge and awareness grows, parents will begin looking for safe harbours. Just like they now check product reviews before buying a stroller or booking a vacation, they’ll start vetting the tools their kids are exposed to. That includes educational apps, financial literacy platforms and even the institutions that recommend them.

Organizations that serve families and youth will increasingly be judged not just by their offerings but by their principles. Who do they partner with? How do those partners treat privacy? Are the tools truly designed for safety or simply dressed up that way?

For credit unions and community-based institutions, this is a defining moment. Trust has always been your advantage. In the digital age, it must be your strategy.

Currency Marketing: built for trust from day one

At Currency Marketing, we believe education should empower, not extract. Our It’s a Money Thing financial education program was built with trust and transparency at its core. Our materials are used in classrooms, communities and credit unions across the United States and Canada.

We don’t harvest data. We don’t run hidden ads. And we don’t use gamification tricks designed to boost engagement at the expense of privacy. Our content is built for learning, not for surveillance.

A challenge worth accepting

There are plenty of apps in the financial literacy space that promise quick engagement or youth appeal. But quick isn’t the same as safe. And flashy isn’t the same as trustworthy.

As an industry, we must do better. If you serve young people through education, finance or outreach, it’s time to look again at the tools you’re using. Not just what they offer, but how they work. And who they ultimately serve.

Because in a world of synthetic identities, behavioral profiling and unchecked digital influence, trust isn’t nostalgic, it’s necessary.