What Gen Alpha wants to be when they grow up

Photo by Pavel Danilyuk

A survey of 11,452 children aged 12 to 15 in 18 countries highlights the career dreams of Generation Alpha. Girls most often want to be artists such as musicians, dancers, actors or painters (21 percent). Healthcare is also popular, with 19 percent aiming for medical careers. Boys lean toward science and technology. Thirty percent want to be scientists, engineers or inventors, while 25 percent hope to design video games or work in tech.

These choices reflect the digital culture they are growing up in. Creative ambitions are shaped by platforms like YouTube and TikTok, while science and gaming careers mirror the rise of esports, STEM promotion in schools, and constant access to technology. Compared with Millennials, fewer now say they want to be athletes or teachers. The shift shows how quickly the cultural environment shapes career dreams.

Source: Visual Capitalist

How Gen Z’s dreams compare with reality

The experience of Gen Z and Millennials shows how career goals shift once students leave school.

A 2025 Deloitte survey found that only 6 percent of Gen Z and Millennials list leadership as a primary career goal. Most instead prioritize learning, financial security and meaningful work.

A Gallup-JFF-Walton Foundation survey reports that only one-third of Gen Z high school students feel well informed about bachelor’s degrees or career paths. Fewer than 20 percent know about alternatives like apprenticeships or certifications. Less than 30 percent feel “very prepared” to pursue their next step.

Many graduates struggle to connect dreams with job offers. About 58 percent of recent Gen Z graduates remain job hunting, compared with 25 percent of older cohorts. Only 12 percent secure employment by graduation, far lower than the nearly 40 percent reported in earlier generations. Even those who do find work often end up underemployed, taking jobs that do not require a degree.

Retention is also an issue. Randstad reports that Gen Z workers leave jobs at higher rates than older colleagues. Yet when positions include training, career progression and alignment with values, attrition declines, particularly in healthcare, technology and financial services.

Why financial literacy matters

Gen Z faces difficult financial realities. Rising living costs and debt limit their options. Housing costs in particular mean many delay moving out on their own. Many now say they plan to be financially independent by age 32. Over 60 percent believe a full-time job will not provide enough income so they look to side hustles, investing and digital finance tools. Yet only 17 percent feel confident in their investment knowledge.

Financial literacy can help close this gap. Several studies confirm its impact:

A 2024 analysis of the U.S. National Financial Capability Survey found that financial literacy programs improved spending habits, debt management and confidence in repayment

A separate 2024 study showed that stronger financial literacy led to more investing, greater participation in financial markets and improved decision making

Forbes reports that Gen Z records the lowest financial literacy scores of any generation, with only 38 percent answering questions correctly

Only 20 percent of Gen Z adults seek professional advice, despite major challenges like student loans and housing costs

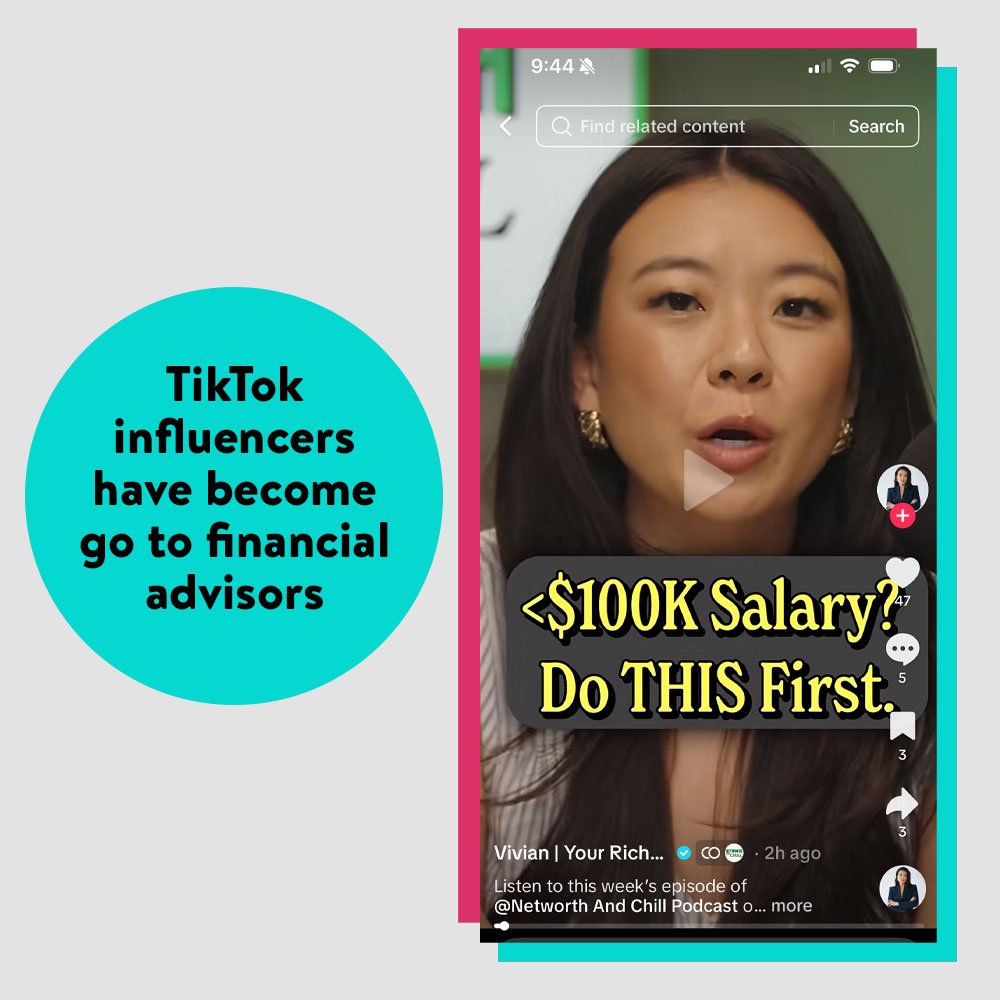

The TikTok effect

For both Gen Z and Gen Alpha, TikTok has become a default financial advisor. Surveys show about 40 percent of Gen Z say they use TikTok to get money tips before turning to a bank or a family member. Young users watch influencers explain credit cards, mortgages, crypto and stock tips in 30-second clips. Some of that content is useful. Much of it is not. The platform is fast, entertaining and highly trusted by its audience. Which makes it a serious competitor for attention.

The risks are clear. Viral TikTok trends have pushed risky stock tips, promoted high-interest credit cards, and spread false claims about student loan forgiveness. For young people who lack other sources of advice, these messages can have lasting consequences.

This is also where the opportunity lies. Credit unions cannot expect young people to come to them. They must go where the kids are. That means using TikTok and other youth-first platforms not only as marketing channels but also as places to deliver credible financial education. Short, clear, relatable content can cut through the noise and establish credit unions as trustworthy sources.

Why credit unions should act now

Credit unions have a unique chance to reach young members before they build long-term financial habits elsewhere. North America’s population is aging and credit union members are on average a decade older than the national median. Recruiting and retaining Gen Alpha, Gen Beta and Gen Z members is critical for long-term sustainability.

Young people want guidance they can trust. Many rely on parents or TikTok for financial information, which is inconsistent at best and misleading at worst. Credit unions can provide better solutions through local partnerships with schools, digital learning platforms and youth-focused campaigns on the same social media channels their members use every day.

Programs like It’s a Money Thing provide a ready answer. They give credit unions classroom resources, digital video content, including short-form video content ideal for TikTok and other platforms.

The reward is twofold. Credit unions improve financial health in their communities and secure long-term loyalty from the next generation of members. Those who build trust early will be the institutions that Gen Alpha and Gen Z grow with, borrow from and stay with throughout their financial lives.