Credit Unions: Financial education is your competitive advantage with Hispanic consumers

The U.S. Census Bureau shows Hispanics surging as a population group. Also surging: Hispanic adoption of alternative financial services. It is a promising opportunity for credit unions. Particularly those looking to expand product, service and financial inclusion mandates. And many have. Juntos Avanzamos, an organization of Hispanic-focused credit unions, boasts 123 member institutions across 27 states.

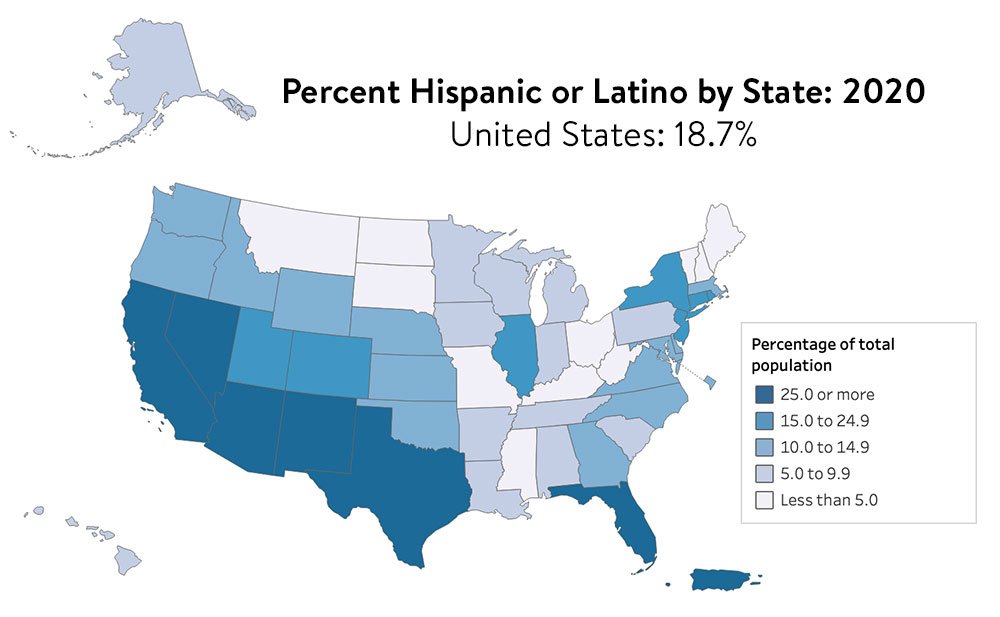

Hispanic demographics

2020’s U.S. census shows the Hispanic population at 62.1 million. A 23% increase from 2010, outpacing U.S. growth of 7%.

Hispanics account for 18.7% of the total U.S. population of 331 million. Estimated to reach 129 million (38%) by 2060.

Financial growing pains

Counter to the opportunity and the effort by credit unions to meet Hispanic market needs is recent data from Latino research group MitúIntell. The study highlights high use of alternative financial services, high-risk investing choices and lower average homeownership and trust in financial advice.

26% invested in cryptocurrency vs. 16% of adults

30% use budgeting apps vs 22% of non-Hispanics

60% use check cashing services vs 5.5% of non-Hispanics

46% own a home vs. 73% non-Hispanics

56% learn financial advice from parents vs. 12% seeking knowledge from financial advisors

The risk of financial illiteracy

FINRA’s National Financial Capability Study of close to 30,000 American adults is in its 5th edition. The report concludes with a consistent set of findings found in all previous reports since 2009. Hispanic/Latino Americans are struggling in contrast to other racial/ethnic groups, who are better off.

The report cites the key contributor to better financial circumstances is high financial literacy. Individuals with high financial literacy are more likely to demonstrate positive financial behaviors such as saving and planning for retirement, and less likely to engage in negative behaviors such as expensive borrowing methods, and high-risk investing.

How credit unions can win

Credit unions can differentiate themselves and build trust by providing financial literacy tools and resources for Latinos to learn about financial products and services, implementing outreach programs and sharing educational materials in print and online – and in Spanish.

We cover the financial topics Americans refer to in many surveys. Our Emergency Fund Boot Camp topic is a very good example of how we’re responding, and one of the most requested by credit union members.

Please reach out if you’d like to know more. I’d love to show you how It’s a Money Thing will add value to your credit union and your membership.

Tim McAlpine is the CEO of Currency Marketing. He is best known for developing the It's a Money Thing Financial Education Program that credit unions from around North America are using to connect with new young adult members. He is also a driving force behind CUES Emerge, an emerging leader program that combines online learning, peer collaboration and an exciting competition component.