Financial literacy is at a five-year low. How will credit unions respond?

Financial literacy in the U.S. is at a five-year low. This is according to the P-Fin Index, an annual 28-question survey of U.S. adults on financial literacy. Conducted annually, the survey paints a grim picture—particularly that of a detrimental relationship between low financial literacy and financial outcomes. Chiefly, the survey finds that those with low financial literacy are more likely to have financial challenges, like difficulty making ends meet and struggling with debt.

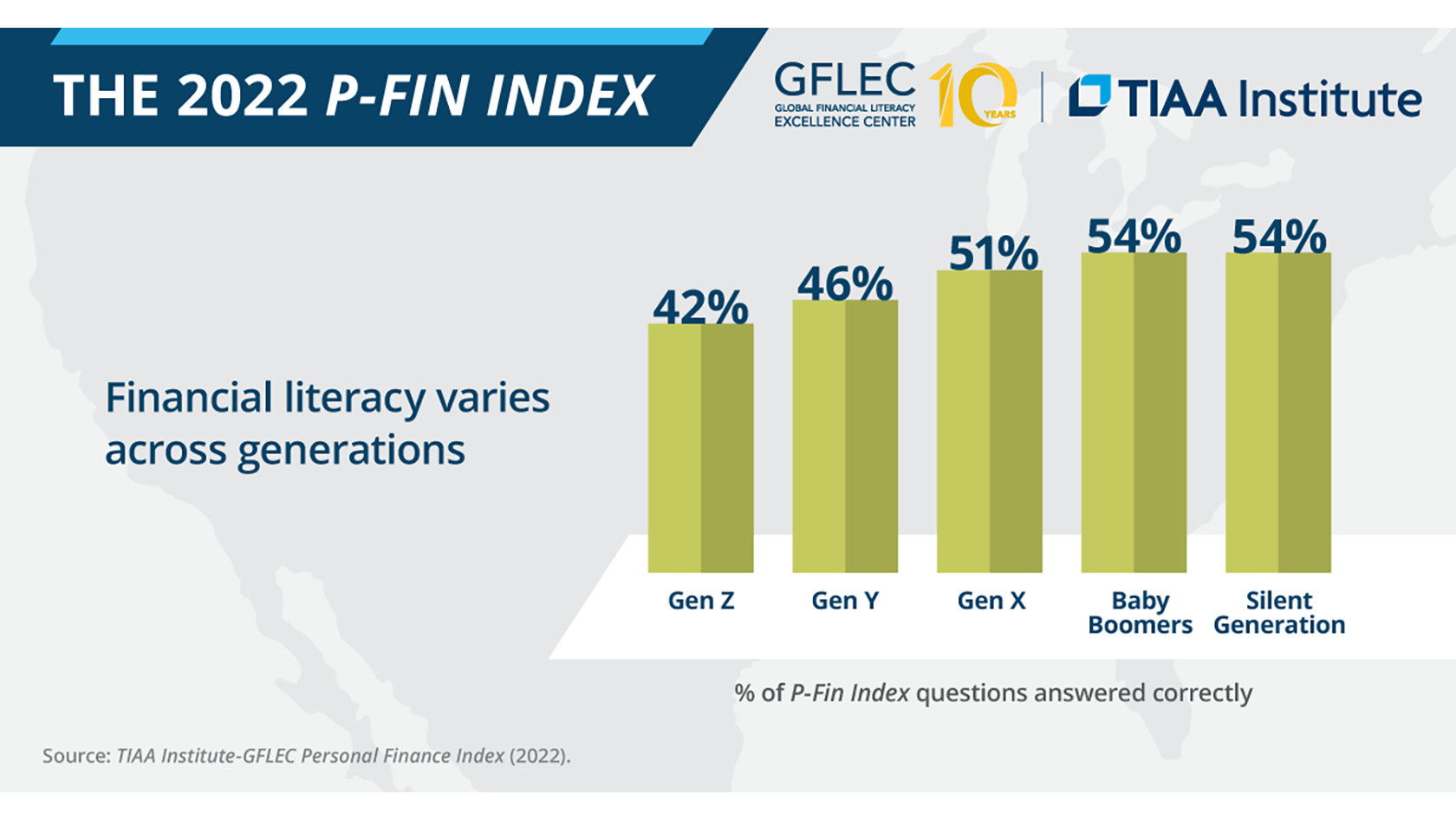

Adults answered only half of the questions correctly, on average. And almost a quarter (23%) of adults could not correctly answer more than seven of the 28 questions. Survey data illustrates financial literacy variances exist across race and ethnicity, and generations.

The impact of low financial literacy levels

People with low-level financial literacy, versus those with high levels of financial literacy, are six times more likely to have difficulty making ends meet. Additionally, those individuals are three times more likely to be debt constrained, or unable to cope with a $2,000 financial shock. And four times more likely to spend more than 10 hours a week on issues related to personal finances.

Why should credit unions invest in financial literacy?

Research shows, as in this recent report from FINRA, that financial education is a cost-effective way to increase financial knowledge and improve a host of behaviors related to budgeting, saving, credit, insurance and more.

Credit unions that invest in delivering financial literacy advice and mentorship will help their members reduce and eliminate debt, manage their ongoing commitments, such as mortgages and loans, and increase their wealth over time. Credit unions win by deepening member relationships and increasing profitability.

Boost your membership’s financial literacy with It's a Money Thing

Tim McAlpine is the CEO of Currency Marketing. He is best known for developing the It's a Money Thing Financial Education Program that credit unions from around North America are using to connect with new young adult members. He is also a driving force behind CUES Emerge, an emerging leader program that combines online learning, peer collaboration and an exciting competition component.