Social media and financial literacy

Social media is an excellent place to publish financial literacy content but credit unions must vet their sources to stay credible

More and more credit unions are launching financial literacy programs and social media has become a popular tool to reach target audiences. While social media can be an excellent tool for increasing your membership’s financial literacy, it’s important to ensure that the information you’re publishing is both accurate and relevant to your audience.

Why improve financial literacy?

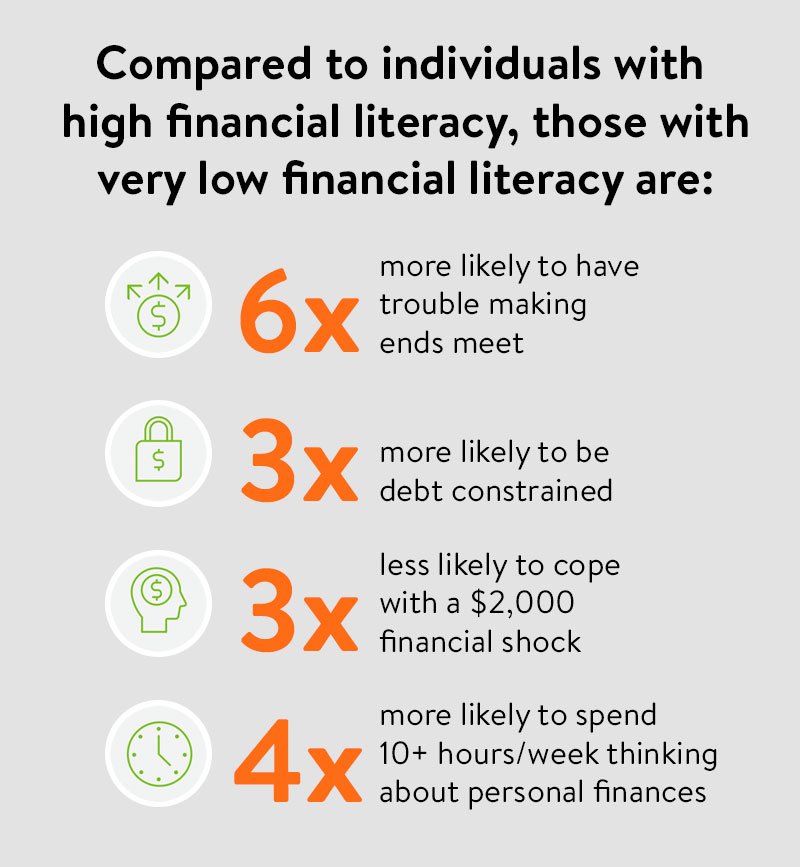

Financial literacy levels are historically low and poor financial literacy is linked to poor financial outcomes. In an annual 28-question financial literacy survey, U.S. adults answered only one-half of the questions correctly and 23% of adults could not correctly answer more than 7 of the 28 questions.

The downsides to low financial literacy

Why social media?

Social media-driven education aligns with consumer preferences. Pew Research reports about half of U.S. adults get their news from social media. In a world of social media misinformation and misrepresentation, credit unions have an advantageous position. Overall satisfaction with credit unions in the U.S. is 76%, according to ACSI.

Four social media strategies for financial literacy

1. Be a trusted financial information resource

To become a trusted resource, your content must be accurate, useful and relevant to your audience. In other words, it’s important to check your content sources, facts and educational value.

2. Post frequently and variedly

There’s no magic formula for how often you should post. However, three to four posts per week should be enough to keep your audience engaged. Varied content also helps engagement—consider a mix of videos, infographics, text-based posts and articles.

3. Engage with your members

Social media is a two-way communication channel. Consider positioning your team to monitor and respond to questions, comments and concerns in a timely manner. Staying connected with followers will help to build your credit union brand. A recent survey of consumer attitudes toward brands shows that following positive social interactions, consumers are more willing to buy, choose or recommend a brand 77% of the time on average.

4. Take a short-cut with a financial education content producer

This is more of a recommendation than a strategy. Save some time and a lot of effort by choosing to work with a financial education content producer that specializes in credit unions. A company with a ready-to-deploy library of financial education digital media. Currency Marketing offers curated content that is proven effective and is highly rated and loved by students, educators and credit unions throughout the U.S. and Canada.

Tim McAlpine is the CEO of Currency Marketing. He is best known for developing the It's a Money Thing Financial Education Program that credit unions from around North America are using to connect with new young adult members. He is also a driving force behind CUES Emerge, an emerging leader program that combines online learning, peer collaboration and an exciting competition component.