Gain small business banking market share

The key differentiators in gaining small business banking market share

Photo by Tim Douglas

Credit unions face stiff competition from banks in the small business enterprise (SME) market, where banks currently hold a dominant position, with 96% in the US and 71% in Canada. However, credit unions possess several advantages that can help them make inroads and gain a larger share of this market. Among these advantages, customer service and financial education stand out as important differentiators.

According to recent reports, customer service plays a significant role in influencing SME owners' decisions to switch their banking relationships. The Canadian Federation of Independent Business (CFIB) found that 10% of business owners changed their banking provider between 2019 and 2022, with credit unions being the primary beneficiaries of these switches. The reasons cited for switching included poor customer service (52%), issues with financing (44%), and fees/pricing (39%). Canadian credit unions' market share in 2022 was reported at 13%, placing them ahead of major players such as the Canadian Imperial Bank of Commerce (9%), thanks in large part to their emphasis on superior customer service.

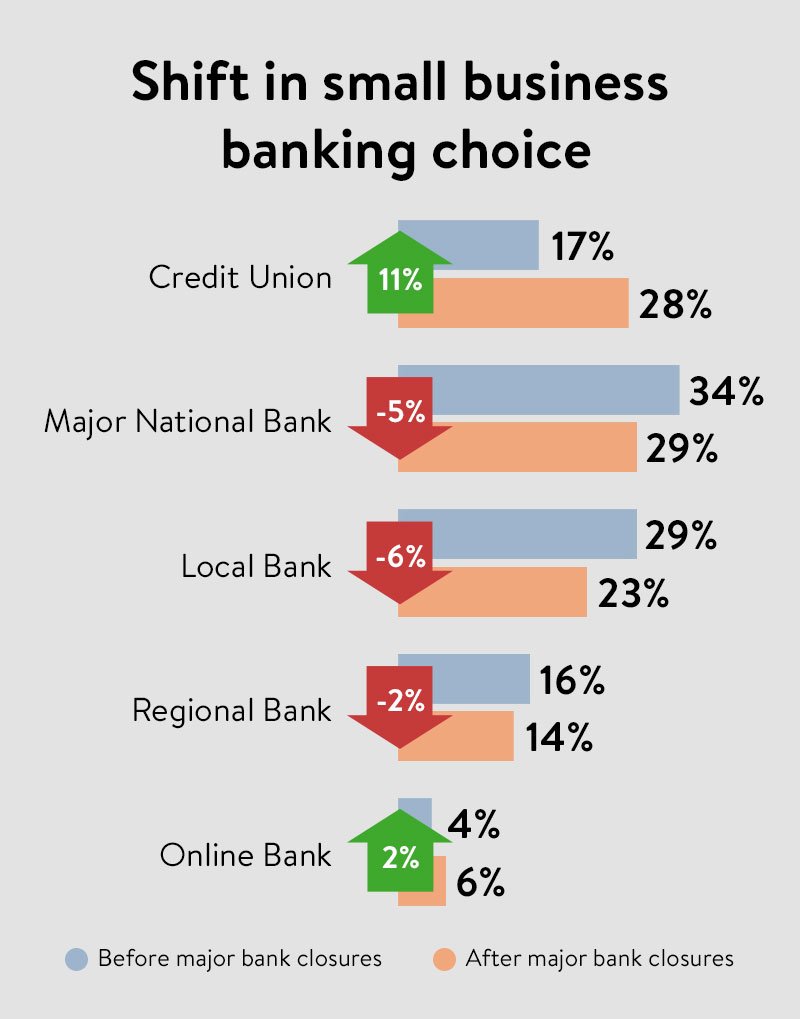

A survey from Alignable in Boston, reinforces this trend, showing that small business owners are increasingly concerned about banking instability and inflation. As a result, many small businesses have made a collective shift towards local credit unions, where they have discovered a higher level of service. In the survey, 17% of U.S. SMEs and 10% of their Canadian counterparts decided to move their funds out of traditional banks, leading to a notable 11% surge in credit union usage. Consequently, credit unions now hold a 28% share among small business owners who participated in the survey. Many of those owners feel that local credit unions provide a more personal and secure banking experience compared to large banks.

Source: Alignable

The education tool to seal the deal – financial wellness programs

While excellent customer service is a powerful driver for credit unions' success, there is another area of opportunity that can further enhance their competitive edge – providing financial wellness programs to small business employees. In today's uncertain economic climate, employees are increasingly turning to their employers for support in managing financial stress and improving their financial wellness.

A study by Brightplan shows that financial wellness-related benefits have become the most desired employee perk, surpassing even mental health benefits and flexible time off. In fact, the demand for financial wellness benefits increased from 29% in 2021 to 54% in 2022. Offering such benefits can have a profound impact on employee productivity, retention and engagement. In all, 95% of workers stated that they would be positively affected by these initiatives.

Credit unions have a unique opportunity to leverage this trend by introducing a financial education program tailored for their commercial business members. By providing It's a Money Thing free to their commercial business members, credit unions can demonstrate their commitment to supporting the financial wellness of both business owners and their employees. This program equips SME employees with essential financial knowledge, empowering them to make informed decisions about their finances and alleviating financial stress. As a result, businesses may experience increased employee productivity, engagement and retention, which can ultimately lead to long-term growth for credit unions.

In the face of bank dominance in the SME market, credit unions have the potential to make significant inroads by capitalizing on their strengths. Superior customer service, backed by reports of satisfied SME owners switching to credit unions, has already proven to be a powerful differentiator.

Moreover, providing a free financial education program like It's a Money Thing to small business employees can further elevate credit unions' appeal, helping them gain a competitive edge and secure a larger share of the lucrative small business enterprise market in North America. By focusing on marketplace awareness and delivering enhanced member services, credit unions can position their institutions for success and growth in an ever evolving financial landscape.

Tim McAlpine is the CEO of Currency Marketing. He is best known for developing the It's a Money Thing Financial Education Program that credit unions from around North America are using to connect with new young adult members. He is also a driving force behind CUES Emerge, an emerging leader program that combines online learning, peer collaboration and an exciting competition component.