Closing the financial gap for Hispanics and Latinos

Photo by Luis Quintero

Hispanic Heritage Month (Mes Nacional de la Herencia Hispana) is currently underway. In the United States, this annual celebration, dating back to 1968 during the Johnson administration, spans from mid-September to mid-October. It is a time to honor the contributions and influence of Hispanic Americans on the nation's history and culture.

In Canada, Latin Hispanic Canadian Heritage Month, established in 2018 with the introduction of Canada's Latin American Heritage Act, takes place throughout October. This month serves as a reminder of the ongoing contributions that Canadians of Hispanic origin make to their country.

Amidst the festivities, it is essential to recognize a concerning reality—one that is rarely cause for celebration. We are seeing the persistent growth in financial disparities among Hispanics, North America's largest ethnic group, comprising around 64 million people.

As financial leaders in the communities they serve, credit unions have a unique opportunity to bridge the financial divide faced by Hispanics and Latinos and drive transformative change in the financial well-being of this expanding ethnic group and the broader communities they represent.

Recent studies

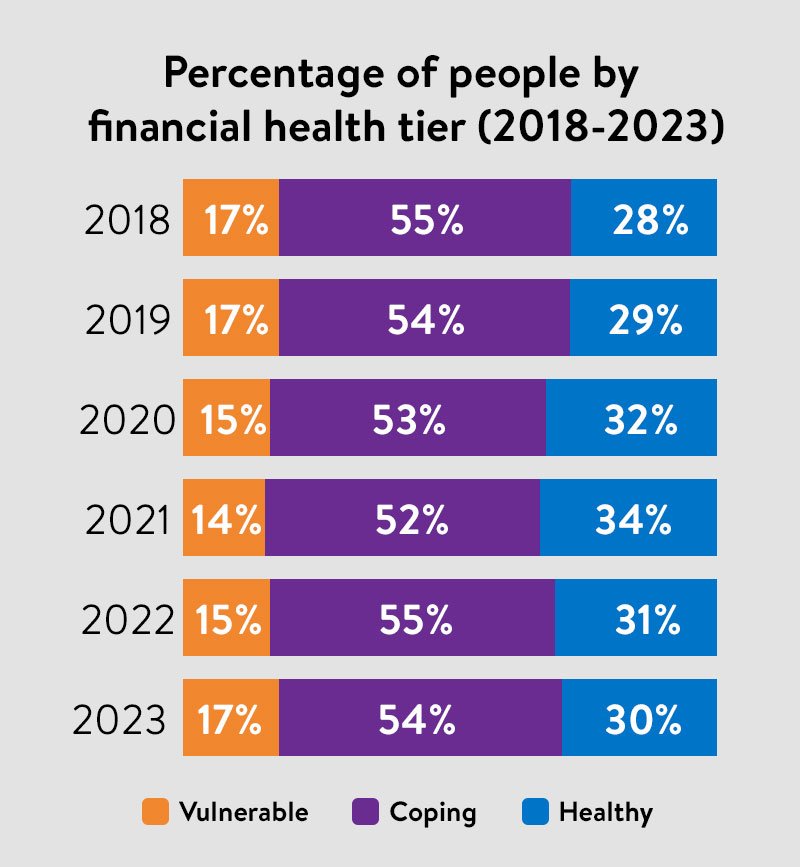

Recent studies reveal financial disparities among North American adults. The Financial Health Network's Financial Health Pulse 2023 U.S. Trends Report highlights the escalating financial vulnerability among Americans. Notably, Latinx Americans bear a disproportionate burden, with the share of financially vulnerable individuals increasing from 15% in 2022 to 17% in 2023.

Source: Financial Health Network

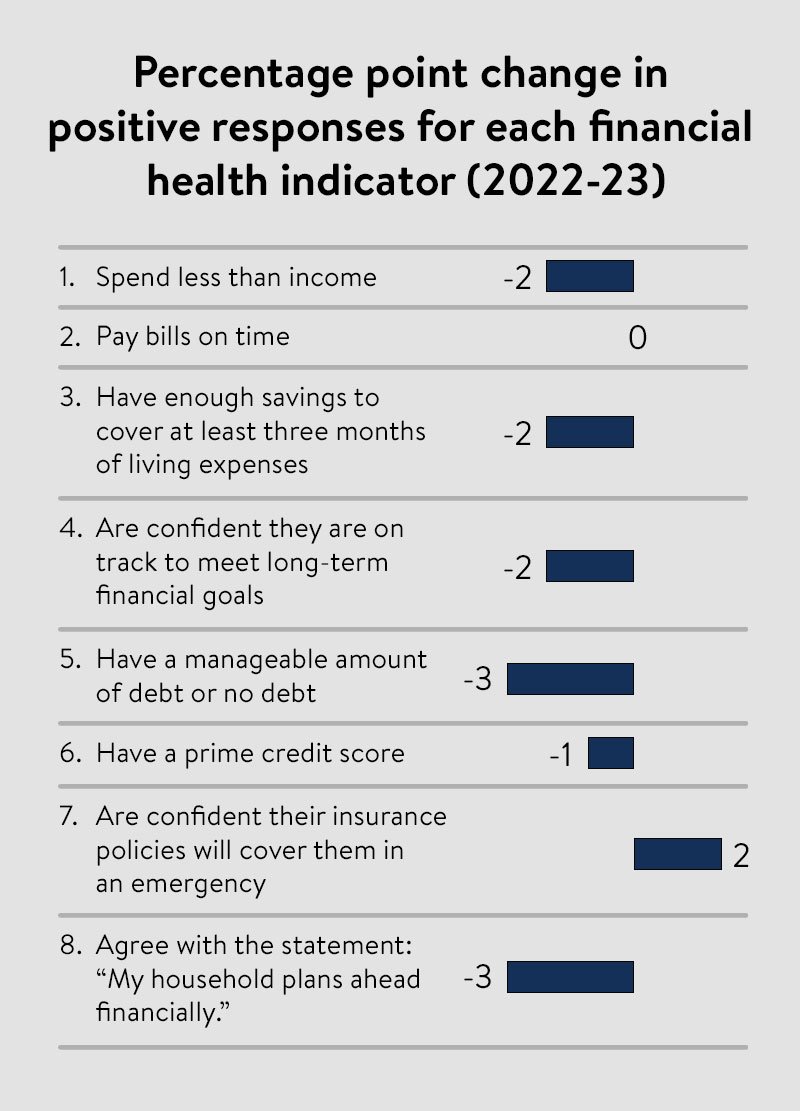

The report underscores decline across all four pillars of financial health: spending, saving, borrowing and planning.

Source: Financial Health Network

Most concerning is the fact that Black and Latinx communities are disproportionately impacted, experiencing a surge in financial vulnerability.

Source: Financial Health Network

Additionally, a report from the Financial Consumer Agency of Canada highlights a decline in financial well-being among Canadians (of which 2.5% are Hispanic) over the past couple of years.

These findings paint a dire picture, but they also emphasize the critical need for intervention. How can we address this growing financial divide? While experts agree there are various strategies, one of the most effective and widely recognized approaches is improving financial literacy through financial education.

Dr. Annamaria Lusardi, a renowned economist and researcher, underscores the paramount importance of financial education in enhancing financial well-being. She argues that financial education equips individuals with the knowledge and skills essential for making informed financial decisions. This, in turn, leads to better financial outcomes, increased savings, reduced debt and enhanced overall financial security. Dr. Lusardi aptly states, "Until financial education is offered in schools, institutions of higher education and workplaces, we will continue to see generations of adults struggling with their personal finances."

This message resonates deeply with our company, Currency Marketing, which has a mission to educate both young people and adults about money. Our commitment extends to the credit union movement in Canada and the U.S., where we provide educational content that integrates from credit union through to school and college curricula. To date, we've empowered hundreds of credit unions to enhance the financial literacy and well-being of their members and communities.

If your credit union serves Hispanic members or communities and you're eager to contribute to their financial literacy and well-being, I invite you to explore our program, It's a Money Thing. We also offer a Spanish language component of our financial education program, recognizing the diverse needs of these communities. Please don't hesitate to reach out for more information or request a demo. I hope you will join us in making a transformative impact on the financial well-being and lives of credit union members and communities.

Tim McAlpine is the Founder & CEO of Currency Marketing. He is best known for developing the It's a Money Thing Financial Education Program that credit unions from around North America are using to connect with new young adult members. He is also a driving force behind CUES Emerge, an emerging leader program that combines online learning, peer collaboration and an exciting competition component.